Loading...

Insights

Practical tips, user stories, and financial strategies that help you track expenses, organize your finances, and make better spending decisions.

Loading...

Insights

Practical tips, user stories, and financial strategies that help you track expenses, organize your finances, and make better spending decisions.

Author

Hey, I’m Daria — an engineer-turned-operations thinker who believes personal finance should be simple enough for anyone to master. After years in engineering, Lean, and a PhD on how to make systems work better for people, I realised something: home finances are just another system — and most of us are stuck using tools that make life harder, not easier. That’s why I write about real money challenges singles and families face, and why we built Billy: a simple, no-nonsense app to track fixed costs, subscriptions, instalments, and all the little expenses that quietly shape your month. My goal? To turn financial chaos into clarity — and help you feel in control of your money without the overwhelm.

92 articles published

This article breaks down how the dopamine reward loop shapes everyday decisions and why today’s fast, digital world makes us more vulnerable to impulse spending and borrowing.

This article explains what budgeting and expense apps do, what they track, where they’re popular, and how people use them to manage their finances.

This article explains how subscription tracking apps are evolving and why the growing subscription economy is increasing demand for simple ways to manage recurring expenses.

Social media shapes what we see and buy. Most of it happens without us noticing.

Free trials and micro-payments feel harmless, but they exploit predictable biases in how we value “free,” avoid losses, and underestimate small repeated costs.

Financial stability is built through ongoing awareness, simple habits, automation, clear goals, and confidence gained from small, consistent actions that gradually create security and freedom.

Christmas is a perfect storm for impulse spending, and for many people the most effective solution is not buying less, but setting clear rules—such as skipping adult gifts altogether.

Monthly money check-ins are an essential habit for maintaining financial clarity, preventing overspending, and staying aligned with long-term goals.

Automating savings removes reliance on willpower and ensures consistent progress toward financial security by turning saving into a structured, habitual process.

We don’t buy things we don’t need because we’re weak—we buy them because our brains love a quick emotional hit and marketers know exactly which buttons to push.

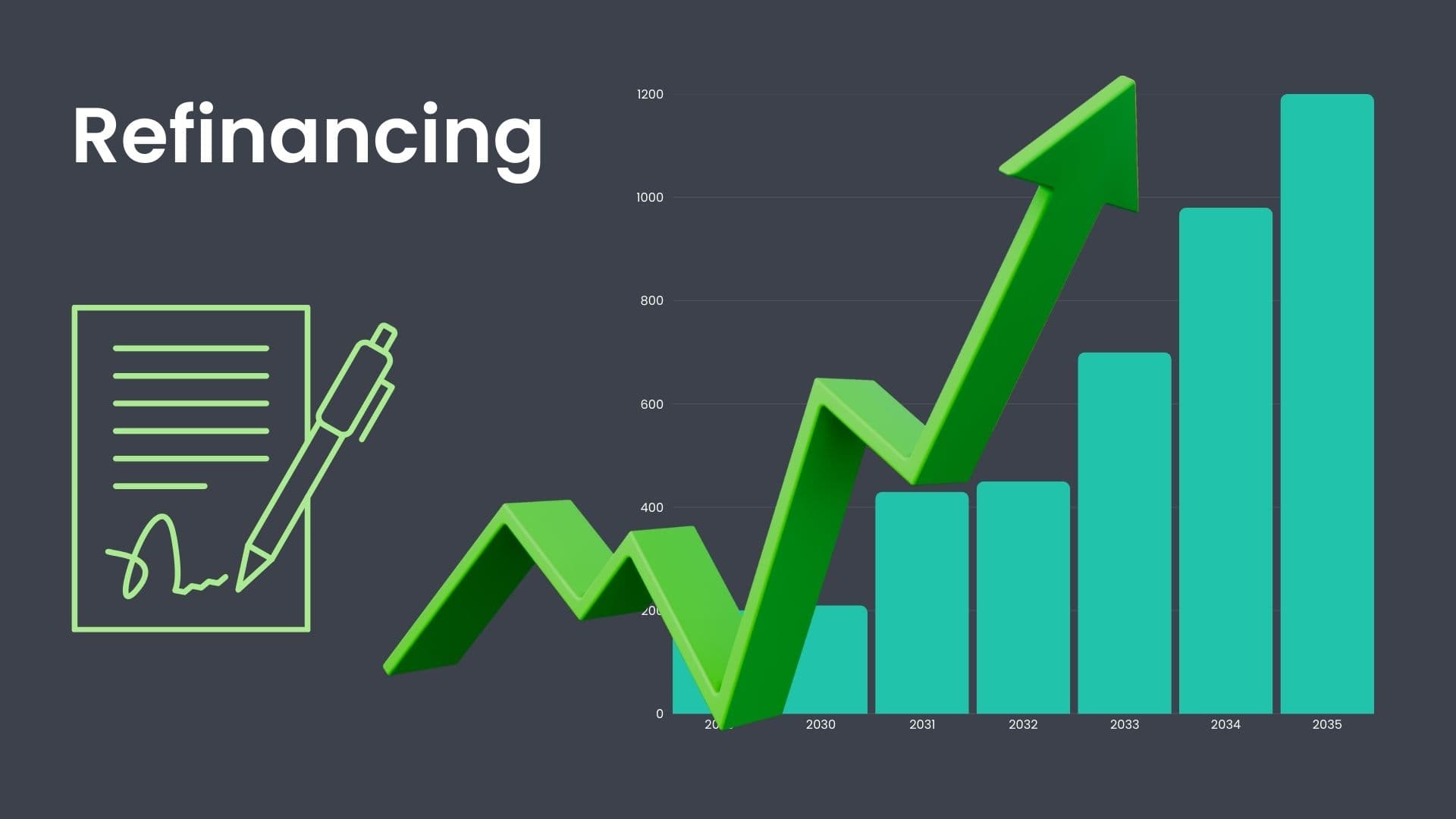

Rising interest rates reflect central banks’ response to high inflation, strong economic conditions, and shifting expectations, supported by extensive research from Wharton, Yale, and MIT economists.

In a world where financial complexity is increasing, AI provides structure, reduces stress, and empowers families to make informed decisions without spending hours on manual budgeting.

Long-term forecasting helps families prepare for the bigger predictable milestones: braces, school transitions, summer camps, or technology upgrades.

Meal planning for one person is both an opportunity and a challenge.

Singles need larger emergency funds due to higher vulnerability, and globally, South Korea leads savings (~35%), while Sweden tops Europe (~25%).

How much does a solo person spend on subscriptions?

Automating bill payments reduces stress, prevents costly mistakes, and creates a reliable financial foundation by ensuring recurring expenses are paid accurately and on time with minimal mental effort.

AI-based savings recommendations are becoming a critical tool in navigating rising household costs.

Between 2026 and 2028, global households will experience a combination of rising electricity costs, steady internet price inflation, and shifting mortgage landscapes.

This case study shows how a modern family can naturally reach 27 subscriptions across work, school, entertainment, health, and convenience. In today’s digital world, this is common and reflects everyday life rather than overspending.

AI-powered smart notifications have quietly become one of the most powerful features in modern personal finance. Instead of discovering too late that you’ve overspent, your banking or budgeting app now alerts you as it happens.

Financial anxiety is one of the most common forms of modern stress.

This article explains why both middle-class and upper-middle-class households lose track of their finances today, showing how stress, complexity, and modern digital systems interact with human psychology.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

A home budget is a simple financial plan that shows how much money comes in, how much goes out, and what’s left at the end of the month.

Artificial intelligence and digital services have reshaped the way we spend money—often without us noticing.

Many people assume financial struggles come from poor planning or lack of discipline—but psychology plays a far bigger role.

In the past decade, the world has moved rapidly away from cash and toward digital transactions. What began as a convenience has now become the dominant way people pay for almost everything—from groceries to streaming services.

Across the world, households are feeling the pressure of a steady rise in the cost of living. While the causes vary by region, several global trends are shaping how much families spend on essential goods, services, and everyday life.

Why Households Overspend: The Hidden Factors Behind Everyday Money Mistakes

Mental accounting is not just psychology—it is tradition, culture, and identity expressed through the way we handle money.

In personal finance, no habit is more powerful—or more underrated—than delayed gratification. It is the ability to resist a smaller immediate reward in order to gain a larger, more meaningful reward later.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

This isn’t laziness or irresponsibility. It’s psychology.

Balancing Lifestyle and Savings: A Global Guide to Smarter Living

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

The Psychology Behind Why We Spend More Than We Think

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

What you pay each month is shaped not only by personal choices but also by global economic forces, and understanding them helps you make better financial decisions.

Amortization is one of those financial words that sounds complicated… but it describes something very simple: how you pay off a loan over time.

Money decisions aren’t rational. They are emotional. Every purchase triggers an invisible tug-of-war inside the brain: the pain of paying versus the pleasure of buying.

Financial Stress Is a Scientific Issue, Not a Personal Failure

A detailed breakdown of costs, interest, amortization, and real long-term impact

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Over the next decade, personal finance will be reshaped by AI-driven automation, expanding subscriptions, demographic shifts, and digital currencies, rewarding households that build resilience, adaptability, and technological readiness.

Today, artificial intelligence (AI) and modern mobile banking apps are changing this dynamic. They automatically scan, categorize, and monitor recurring payments.

Refinancing—whether for a mortgage, car loan, or personal loan—means replacing your existing debt with a new one, ideally under better terms.

Music streaming, digital newspapers, online courses, fitness apps, audiobook platforms—most of these will only show up when you carefully go through your bank account. And almost nobody wants to do that every day.

Budgets Don’t Fail Because of Math—they Fail Because of Psychology

There isn’t one famous “60-day case,” but there is enough evidence to justify a realistic 60-day transformation story based on known mechanisms (reduced avoidance, increased checking, better planning).

The article introduces three unconventional, practical methods that go far beyond generic advice on dealing with financial avoidance. Each approach is grounded in behavioral science and designed to be simple.

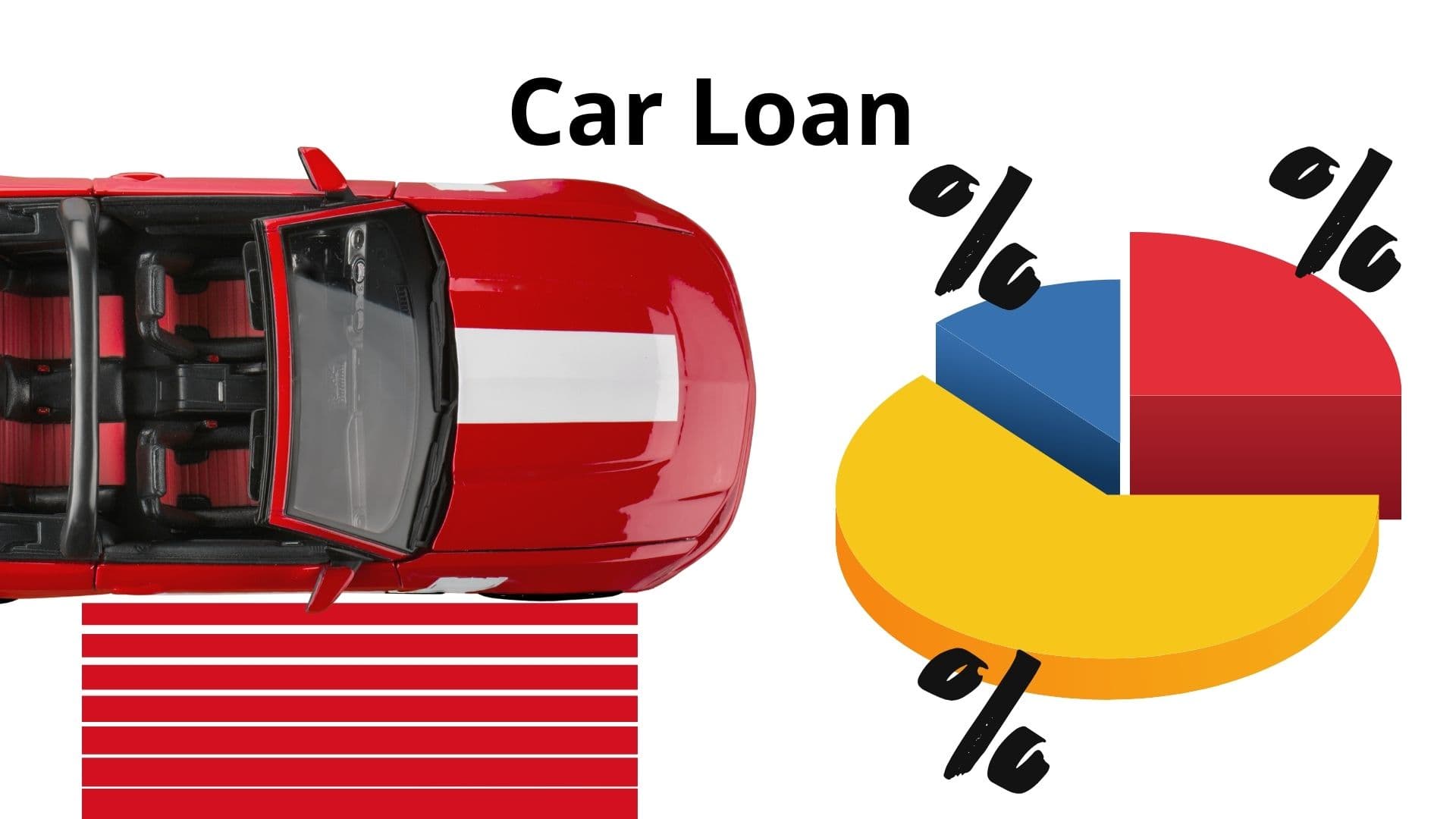

Car loans are one of the most common types of consumer debt, yet few people actually understand how they work.

Leasing a car has become popular because it promises low monthly payments and access to a new vehicle every few years.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Stay tuned! A new article is on the way, packed with insights and practical tips. Coming soon.

Artificial intelligence is rapidly changing the way households manage their finances. One of the most promising developments is the rise of AI-generated budgets

Depreciation directly affects your long-term financial stability: it’s money you will never recover.

Buying a car is one of the biggest financial decisions most households make. And yet, people usually judge affordability by one thing: the monthly payment.

For many households, the car is the second-largest expense after housing. Yet cars are also one of the easiest ways to fall into long-term debt.

At first glance, “0% interest” and Buy Now, Pay Later (BNPL) offers seem like the perfect deal. No extra fees. No interest. Small monthly instalments.

The Financial Pressure of Being Single: A Global Perspective With examples of a 35-year-old marketing specialist living alone in major world cities

This article breaks down how BNPL financing works, how Klarna and PayPal Credit differ from store financing, and how to use these tools without falling into debt traps.

The next generation of AI tools will not only detect fraud but predict it—forecasting risks based on early behavioral signals. Instead of reacting to fraudulent activity, families will receive proactive warnings.

Deciding whether to combine finances or keep them separate is one of the most important conversations couples must navigate.

High-Interest vs. “0% Interest” Plans — What You Need to Know

Understanding how installment plans influence your credit score can help you avoid hidden pitfalls and build a stronger financial foundation.

A scientific perspective on cognitive biases, decision-making, and household finance

Research shows people are more likely to skip financial information when they expect the outcome to be unpleasant. In the moment, ignoring feels easier. But it quietly creates long-term damage.

Why Understanding Your Home Finances Must Come First: The Strategic Link Between Money and Psychology

Celebrating financial milestones in intentional, low-cost ways reinforces motivation and discipline without undermining long-term financial goals.

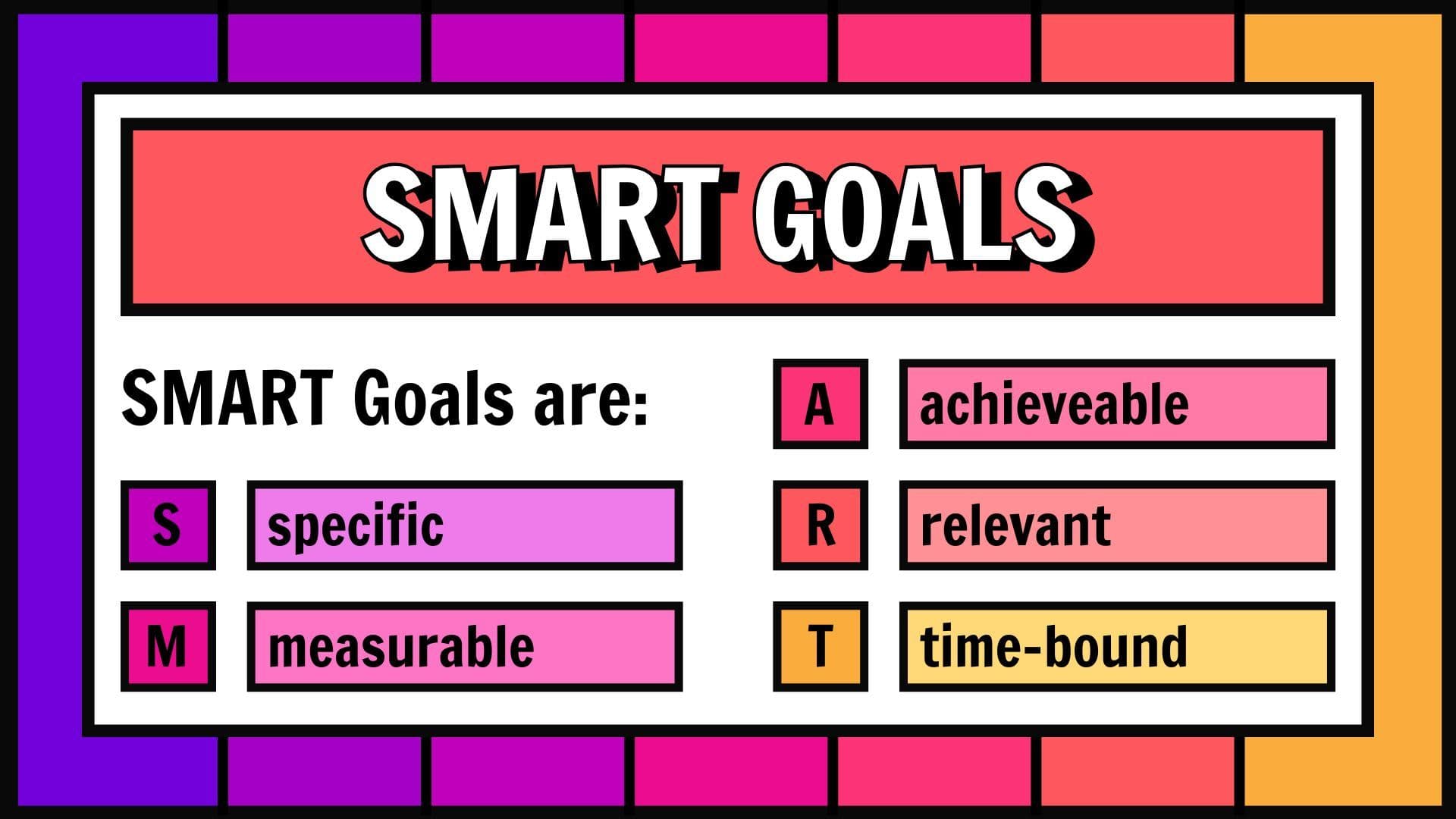

Using SMART goals turns vague financial intentions into clear, trackable, and time-bound plans that support disciplined daily decisions and long-term financial success.

Financial success comes from integrating short-term cash-flow management with long-term goal planning so households can remain stable today while steadily building security for the future.

Geopolitical events—wars, trade disputes, sanctions, political instability, and global tensions—have direct and often immediate effects on household budgets.

Understanding exchange rates helps households anticipate changes in the cost of living, particularly during periods of global uncertainty or economic transition.

Measuring financial progress through clear indicators and regular reviews builds awareness, accountability, and motivation, turning money management into a proactive and sustainable system.

Understanding how energy prices are formed—and how utilities pass costs to consumers—gives families the ability to anticipate changes, adjust behavior, and maintain stable budgets even during periods of global volatility.

Inflation steadily raises prices over time, reducing purchasing power and forcing households to adapt their spending, saving, and investing strategies to maintain financial security.

AI-powered personal finance tools help households maintain control and confidence by providing real-time spending insights, predictive planning, and personalized recommendations that support better financial decisions with less effort.

Financially healthy households succeed not because of perfect budgets or high income, but because they adopt a mindset of awareness, intentionality, resilience, open communication, and long-term thinking.

An annual financial reset helps households regain clarity and control by reviewing past performance, realigning goals, optimizing systems, and strengthening resilience for the year ahead.

Financial uncertainty is unavoidable, but planning for it means building a resilient financial system that can withstand unexpected events.

Financial confidence is the psychological foundation of healthy money habits, empowering individuals and families to make informed decisions, handle setbacks, and pursue long-term goals with clarity and resilience.