Loading...

Insights

Practical tips, user stories, and financial strategies that help you track expenses, organize your finances, and make better spending decisions.

Loading...

Insights

Practical tips, user stories, and financial strategies that help you track expenses, organize your finances, and make better spending decisions.

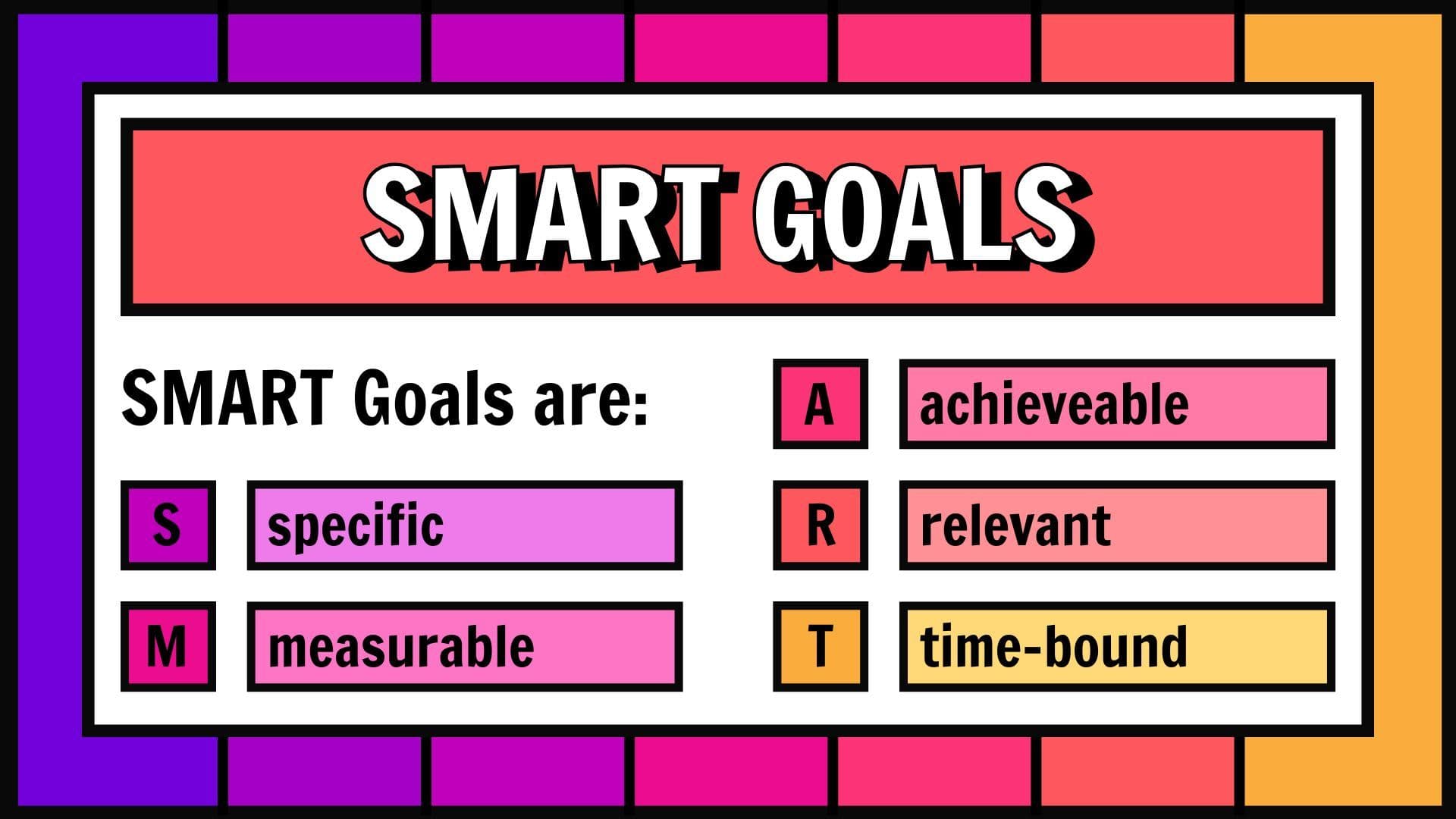

Setting financial goals is easy in theory but difficult in practice. Many people say they want to “save more,” “get better with money,” or “reduce debt,” but these vague aspirations rarely lead to lasting change. The SMART framework—Specific, Measurable, Achievable, Relevant, and Time-bound—transforms abstract intentions into actionable plans. When applied to home finances, it becomes one of the most effective tools for improving financial stability and long-term decision-making.

A Specific financial goal clearly defines what you want to achieve. Instead of saying “I want to save money,” a SMART version states: “I want to save $3,000 for a vacation.” The clarity helps guide daily spending choices. A Measurable goal includes a numeric element—an amount, percentage, or frequency—so you can track progress. This makes budgeting less emotional and more data-driven.

An Achievable goal is realistic. Setting goals that ignore income, fixed expenses, or lifestyle constraints often leads to frustration. Instead, achievable goals consider current financial capacity. For example, saving $200 per month might be reasonable, whereas $800 may not be. Relevant goals align with your values and priorities. A household that values travel, for instance, will be more motivated to save for a vacation fund than for luxury purchases.

Finally, Time-bound goals include deadlines. Without a timeline, goals drift indefinitely. A well-structured example is: “Save $3,000 for a summer vacation by 1 June, contributing $300 per month for the next 10 months.” This provides direction, structure, and accountability.

SMART goals also support collaboration in families or couples. Shared, clearly defined goals reduce misunderstandings and strengthen teamwork. Technology enhances this process: budgeting apps can break large goals into small weekly contributions, send reminders, and adjust timelines when circumstances change.

In a financial world filled with distractions and short-term impulses, SMART goals create discipline and purpose. They transform aspirations into daily habits and long-term achievements.

Sources:

Financial stability is built through ongoing awareness, simple habits, automation, clear goals, and confidence gained from small, consistent actions that gradually create security and freedom.

Monthly money check-ins are an essential habit for maintaining financial clarity, preventing overspending, and staying aligned with long-term goals.

Automating savings removes reliance on willpower and ensures consistent progress toward financial security by turning saving into a structured, habitual process.