Loading...

Insights

Practical tips, user stories, and financial strategies that help you track expenses, organize your finances, and make better spending decisions.

Loading...

Insights

Practical tips, user stories, and financial strategies that help you track expenses, organize your finances, and make better spending decisions.

Category

13 articles in this category

Financial stability is built through ongoing awareness, simple habits, automation, clear goals, and confidence gained from small, consistent actions that gradually create security and freedom.

Monthly money check-ins are an essential habit for maintaining financial clarity, preventing overspending, and staying aligned with long-term goals.

Automating savings removes reliance on willpower and ensures consistent progress toward financial security by turning saving into a structured, habitual process.

Automating bill payments reduces stress, prevents costly mistakes, and creates a reliable financial foundation by ensuring recurring expenses are paid accurately and on time with minimal mental effort.

Over the next decade, personal finance will be reshaped by AI-driven automation, expanding subscriptions, demographic shifts, and digital currencies, rewarding households that build resilience, adaptability, and technological readiness.

Celebrating financial milestones in intentional, low-cost ways reinforces motivation and discipline without undermining long-term financial goals.

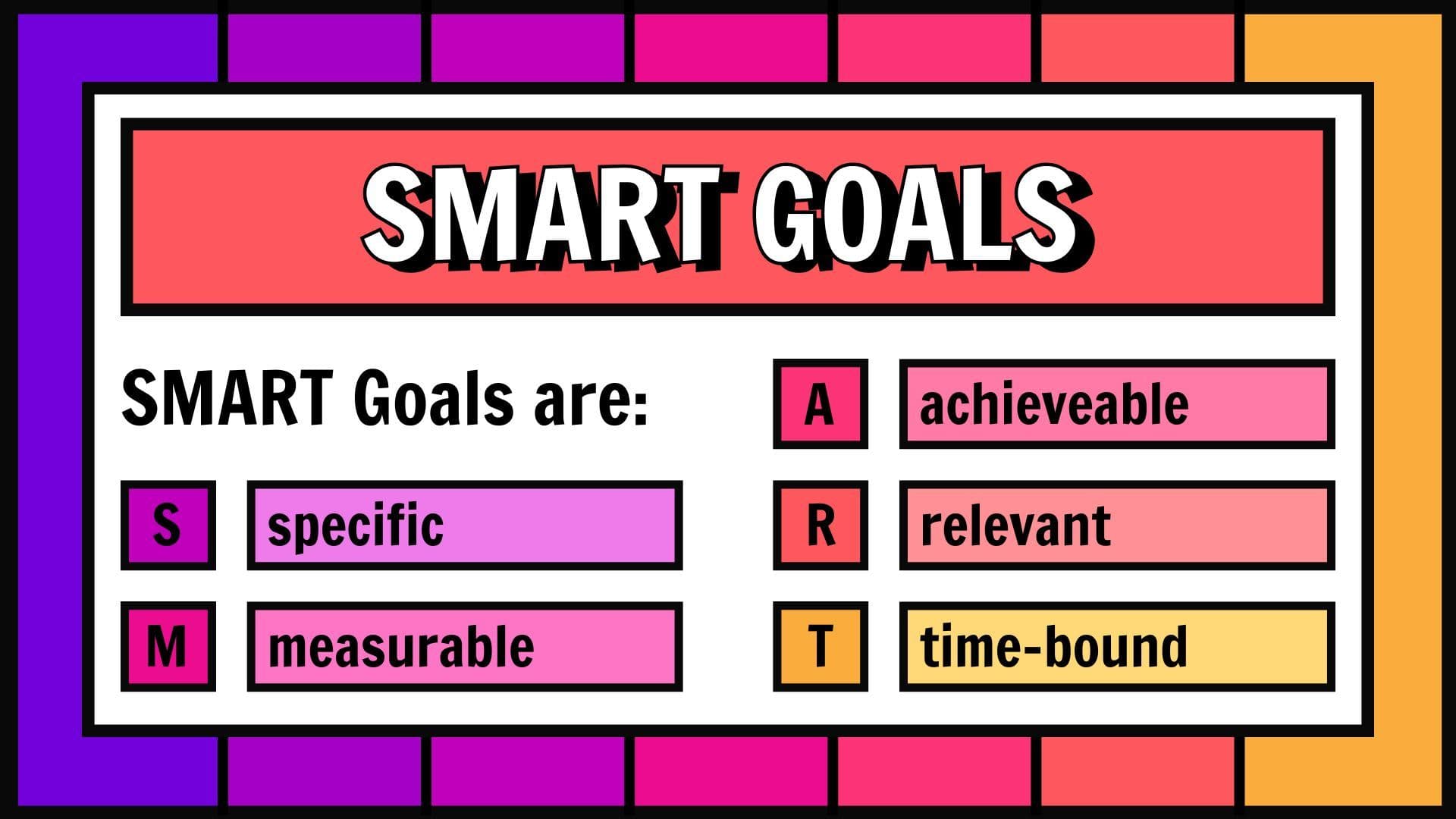

Using SMART goals turns vague financial intentions into clear, trackable, and time-bound plans that support disciplined daily decisions and long-term financial success.

Financial success comes from integrating short-term cash-flow management with long-term goal planning so households can remain stable today while steadily building security for the future.

Measuring financial progress through clear indicators and regular reviews builds awareness, accountability, and motivation, turning money management into a proactive and sustainable system.

AI-powered personal finance tools help households maintain control and confidence by providing real-time spending insights, predictive planning, and personalized recommendations that support better financial decisions with less effort.

Financially healthy households succeed not because of perfect budgets or high income, but because they adopt a mindset of awareness, intentionality, resilience, open communication, and long-term thinking.

An annual financial reset helps households regain clarity and control by reviewing past performance, realigning goals, optimizing systems, and strengthening resilience for the year ahead.

Financial confidence is the psychological foundation of healthy money habits, empowering individuals and families to make informed decisions, handle setbacks, and pursue long-term goals with clarity and resilience.